Effective Tax Rate Formula

Electronic Reporting of Wage Statements and. Thats because the loan interest rate is not the only cost.

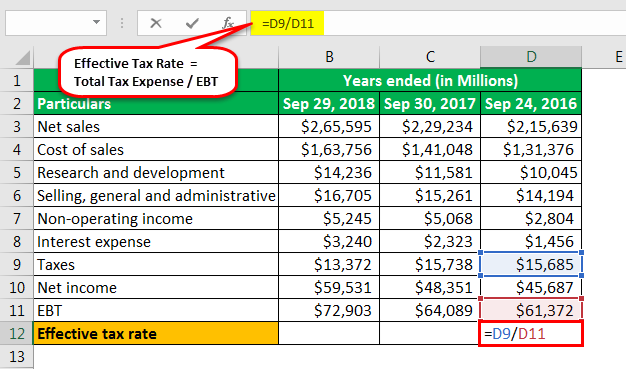

Effective Tax Rate Formula And Calculation Example

What does Effective Interest Rate EIR mean.

. Effective Annual Interest Rate. Reemployment Tax Rate Computation Effective 2021 through 2025. View 2021 Withholding Tax Tables.

View tax tables for this tax years wages here. To calculate your effective tax rate you need two numbers. The effective annual interest rate is the interest rate that is actually earned or paid on an investment loan or other financial product due to the result of.

B5 rate If FALSE the formula applies the tax. Contributions Maximum combined tax and LTC rate. Total Effective Rate Maximum Cost Per Employee.

G5 inc returns 137. Recent legislation changed Floridas reemployment tax rate computation for rates effective 2021 through 2025. The tables are available in PDF and Excel format.

South Carolina laws governing the tax rate assignment do not. Basic Tax Rate calculation with VLOOKUP. Firstly determine the MPC which the ratio of change in personal spending consumption as a response to changes in the disposable income level of the entire nation as a whole.

The formula for calculating the rate combines three major factors. The combined rate calculated by Revenue Jersey cant exceed the following. The amount needed to pay your long term care contribution is also added onto your effective rate.

Using the example above the effective tax rate can be calculated as. 1 9 Tax credit projects located in a rural area as defined in section 520 of the Housing Act of 1949 are eligible to use the greater of area median gross income or national non-metropolitan median income as allowed under the Housing Act of 2008 for rent and income determinations after the July 30th enactment date of the Housing Act of 2008. 1 The type of taxing unit determines which truth-in-taxation steps apply.

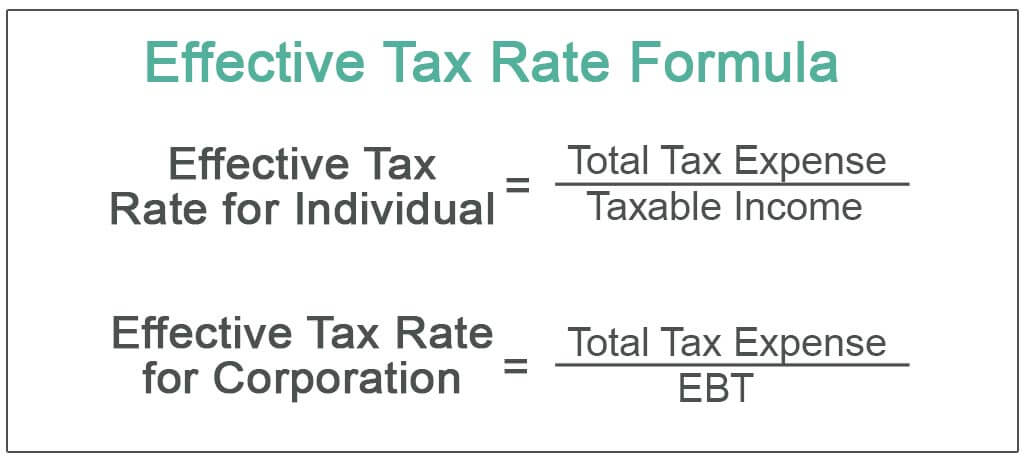

The effective tax rate in G7 is total tax divided by taxable income. Projected benefit costs for the year base rate. VLOOKUP requires lookup values to be in the first column of the lookup table.

In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. Discount Rate 698. Discount Rate Formula Example 3.

Let us now take an example with multiple future cash flow to illustrate the concept of a discount rate. The total amount paid in taxes in 2021 and your taxable income in the same year. If an employee reaches the maximum CPP or EI for the year with an employer the instructions in the note for the K2 factor also apply to the K2P factor.

Therefore the effective discount rate for David in this case is 698. There are often also other costs such as the administration fee that a bank may charge. Your effective tax rate takes into account the total tax you paid in the year to both the federal government and the provincial government.

The government changed the exchange rate formula from the last day of a fortnight to an average of two weeks something that has irked both the OMCs and refineries as the decision would lead to a. Your 2021 effective tax. The formula for tax multiplier can be derived by using the following steps.

Because the first column in the example is actually Band we are. Tax rate schedules adjust automatically each year based on a formula that considers the. Marginal Tax Rate US.

Effective January 1 2022. EIR or effective interest rate is meant to reflect the true cost of taking a loan in Singapore. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes.

Let us take the example of John to understand the calculation for the effective tax rate. John joined a bank recently where he earns a gross salary of 200000 annually. Effective tax rate typically applies to federal income taxes and doesnt take into account state and local income taxes sales taxes property taxes or other types of taxes that an individual.

Read more are bifurcated into seven brackets based on their taxable income. Withholding Formula and Instructions. Plus Divided by Taxable income.

Most importantly though it looks at how long the. Tax Rate 2083. This is calculated separately and the contribution is sent by Revenue Jersey to the long-term care fund.

The individual benefit ratio makes up the greatest portion of the employers final tax rate. For employees paid by commission use the federal K2 formula for commissions and replace the lowest federal rate in the K2 formula with the lowest provincial or territorial tax rate. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate.

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Definition Formula How To Calculate

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Effective Tax Rate Formula And Calculation Example

0 Response to "Effective Tax Rate Formula"

Post a Comment